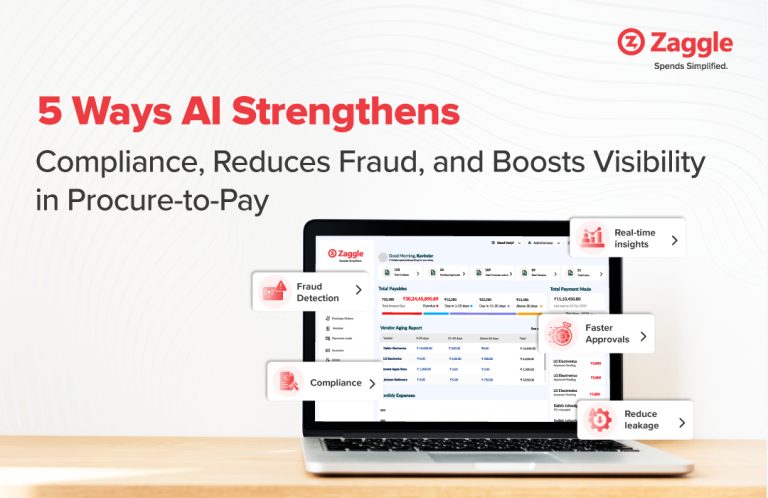

Summary: AI-driven procure-to-pay systems streamline compliance, reduce fraud risks, and improve visibility across the procurement cycle, enabling finance leaders to ensure control, efficiency, and trust in business spend management. Why Compliance and Fraud Control Define Modern Procurement Finance leaders across the board are rethinking how their procurement cycle is managed. From approvals and purchase orders…

Preventing Silent Cash Erosion: Tackling Hidden Costs in Utility Payment Workflows

Every business, whether a well-established enterprise or a growing start-up, comes with numerous obvious expenses. This could include wages, rent, marketing and utility bill payment. However, there are often certain unseen expenses that can steadily and stealthily eat into your earnings. This silent drain isn’t just a small figure. Studies suggest that businesses can unknowingly…

No More Guesswork: Track Every Petty Cash Spend with Spend Management Software

At a rapidly expanding retail chain with locations spread across Maharashtra, managing branch-level recurring spends had become a quiet, persistent challenge. Branch managers bought cleaning supplies from local vendors, settled urgent courier charges in cash, and even paid small repairmen on the spot for equipment fixes. Some expenses were reimbursed immediately, some were noted for…

Behind the Scenes of Multi-Branch Utility Bill Payments: Hidden Costs, Inefficiencies, and Cash Leakage

A growing fast-food chain of restaurants has 100+ outlets across 30 cities. Rajeev is the Head of Finance over there. It is a task for his team to collect electricity, water, and internet bills from each location every month. They rely on spreadsheets, WhatsApp messages, manual approvals, and local vendor receipts. By the time the…

When Petty Cash Management Isn’t So Petty: How it Impacts Multi-Branch Profitability

It was close to the financial year ending, and Sunil Mehra, the CFO of a growing retail chain with 68 branches across India, was trying to make sense of an Excel sheet. Rs. 4 lakhs showed under the vague umbrella of “Miscellaneous Branch Expenses.” There were no receipts or explanations, only a growing sense of…

If You Have Multiple Branches, Your Utility Payments Could Be Costing You Daily

At a mid-sized banking cooperative expanding across West and Central India, utility bills were collected, processed, and sent to the zonal office for payment. Each of their 42 branches operated semi-independently, including how they processed their electricity, water, internet, and sanitation charges locally and sent them to their respective zonal offices for payment. This process…

When Manual Petty Cash Management Becomes Expensive – Why You Can’t Ignore Petty Cash Anymore

At a growing quick-commerce company headquartered in Hyderabad, everyday spending had become a quiet disruptor. Teams made frequent purchases for stationery, urgent warehouse fixes, and local transport, all using petty cash. The amounts were small, but the problems that often surfaced as a result weren’t. For Reema Sharma, who oversaw field operations in the southern…

How to Prevent Petty Cash Leakages with Smart Cash Management Software

At a fast-expanding auto parts distribution company head-quartered in Pune, petty cash expenses were creating a number of setbacks. Each branch had its own process. They used Excel sheets to manage spends across branches, while some made purchases based on verbal approvals. There was no consistency, and certainly no visibility. For Nilesh Kumar, a warehouse…

Navigating Multi-Branch Expenses in The BFSI Domain: A Tale of Control, Compliance, and Automation

Meet Ravi Mehta, who is the Financial Controller of a renowned bank with 200+ branches across India. He recently received the latest audit report and he stared at it for a long time because of what he found in it. It revealed a concerning pattern: unexplained cash discrepancies, delayed rent payments, and uncontrolled spends across…

How to Manage Retail Store Expenses across Multiple Branches

As a CFO or someone managing retail store expenses across multiple branches, reducing fraud and ensuring compliance would be high on your priority list. Yet there is a high chance that your team could be struggling to understand the rising costs, unpredictable expenses, and budget leaks. You know it better than anyone that managing retail…